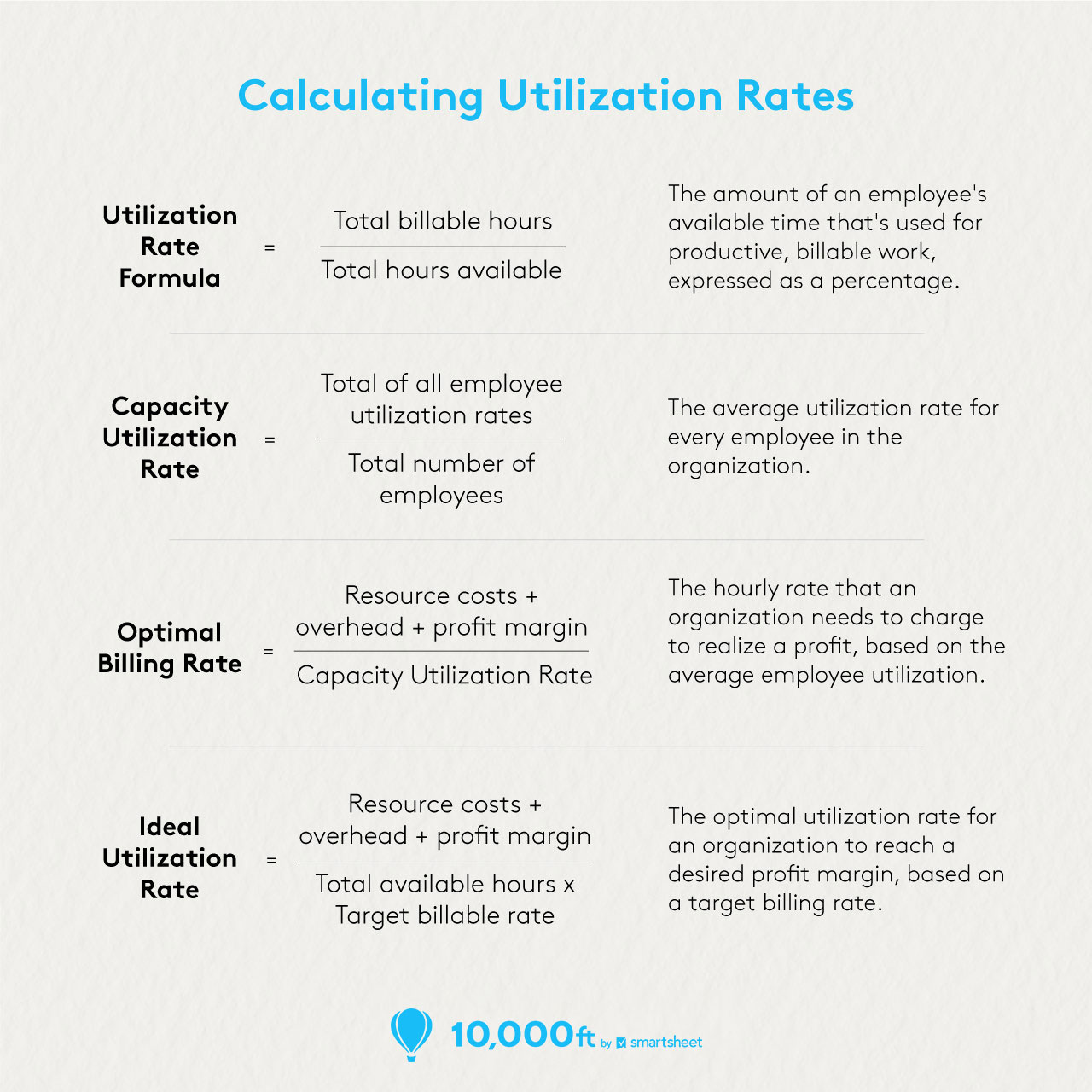

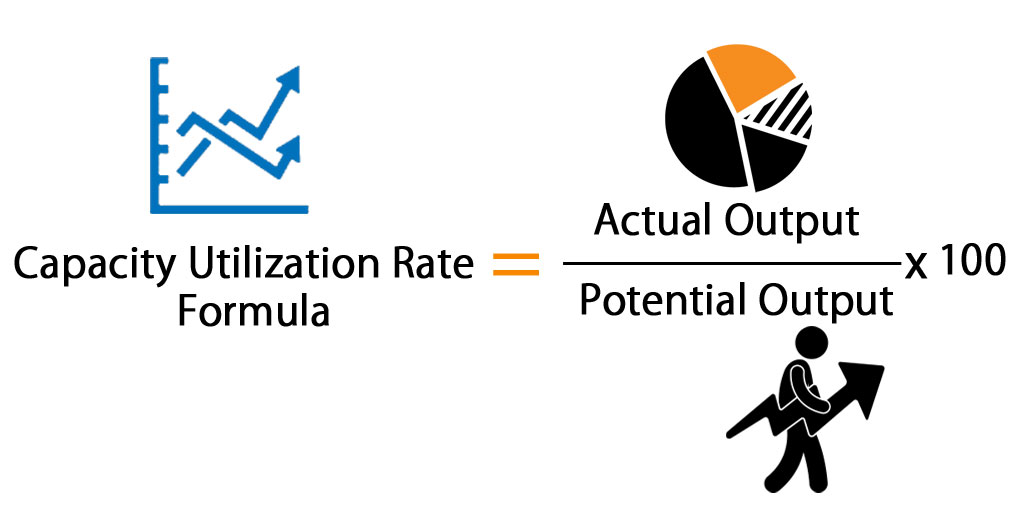

The maximum sales growth is the full capacity sales divided by the current sales, so Maximum sales growth = ($677,778 / $610,000) – 1 Maximum sales growth = 1111 or 1111% We are given the profit margin Remember that ROA = PM(TAT) We can calculate the ROA from the internal growth rate formula, and then use the ROA in this equation to find the total asset turnoverNet sales are basically total sales less any returns or allowances This is the net amount that the company expects to receive from its total salesThe mathematical formula for calculating capacity utilization is Example of Capacity Utilization Suppose XYZ Company is producing ,000 and it is determined that the company can produce 40,000 units The company's capacity utilization rate is 50% (,000/40,000) * 100 If all the resources are utilized in production, the capacity rate is

Chapter 17 Mc Grawhillirwin Projecting Cash Flow And

Full capacity level of sales formula

Full capacity level of sales formula- Hence, for a system working at full capacity, it is the average quantity produced in a given time period If your system is working at less than capacity, however, you cannot take the total production quantity For example, if you produced ,000 gizmos per week, but half of the time your people were idling, then you cannot use the ,000 Practical capacity is the highest realistic amount of output that a factory can maintain over the long term It is the maximum theoretical amount of output, minus the downtime needed for ongoing equipment maintenance, machine setup time, scheduled employee time off, and so forth The amount of practical capacity should be incorporated into an

8 Of 9 Question 4 Total Marks 25 Marks A Basic Lad Sells Product X For Homeworklib

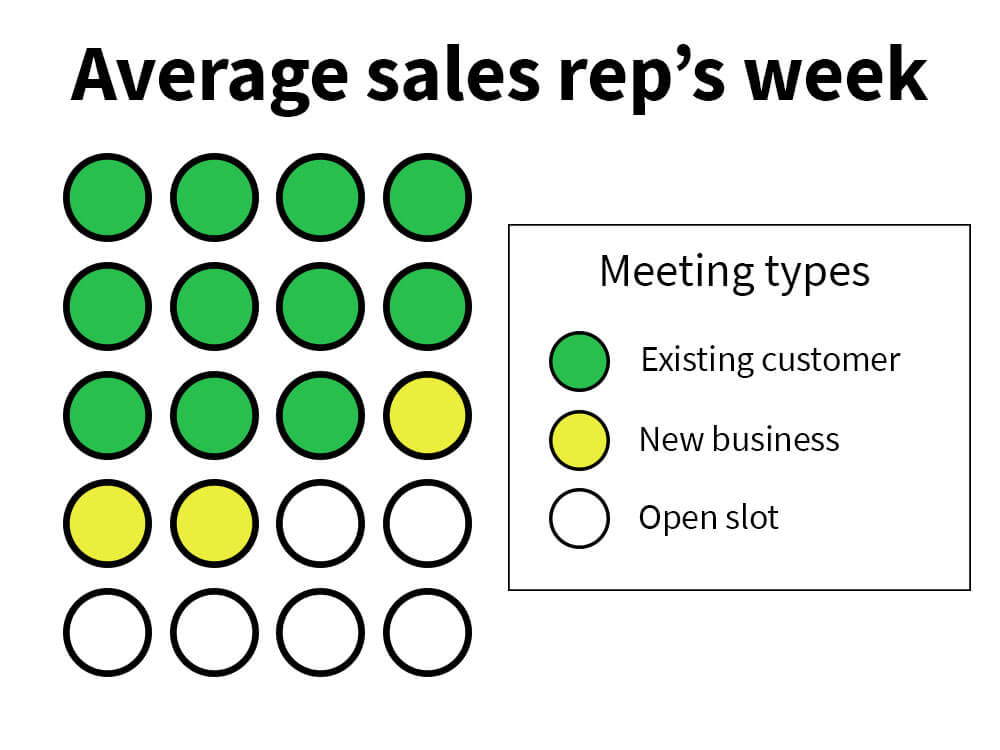

The exact amount of capacity to maintain can be planned for using capacity requirements planning, which calculates required capacity levels at different sales levels and product mixes How to Reduce Capacity Costs It is possible to largely eliminate capacity costs by shifting work to third parties Brought to you by Techwalla Divide the percentage of total sales by the percentage of production in order to obtain the salestoproduction ratio Using the same example, the salestoproduction ratio for red flower pots would be 30 percent divided by 5333 percent, giving a salestoproduction ratio of , or 1178The Sales Productive Capacity Calculator helps sales and sales operations leaders take a datadriven approach to understanding and measuring the productive capacity of their sales teams and identify levers they can apply to improve sales capacity The tool allows users to model the sales productive capacity of a sales role in a future period

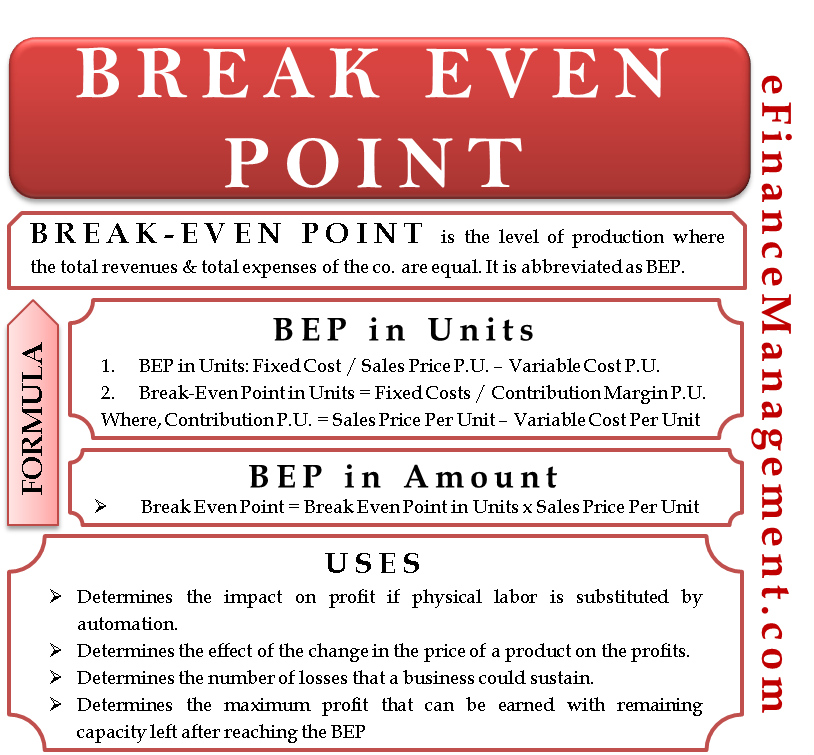

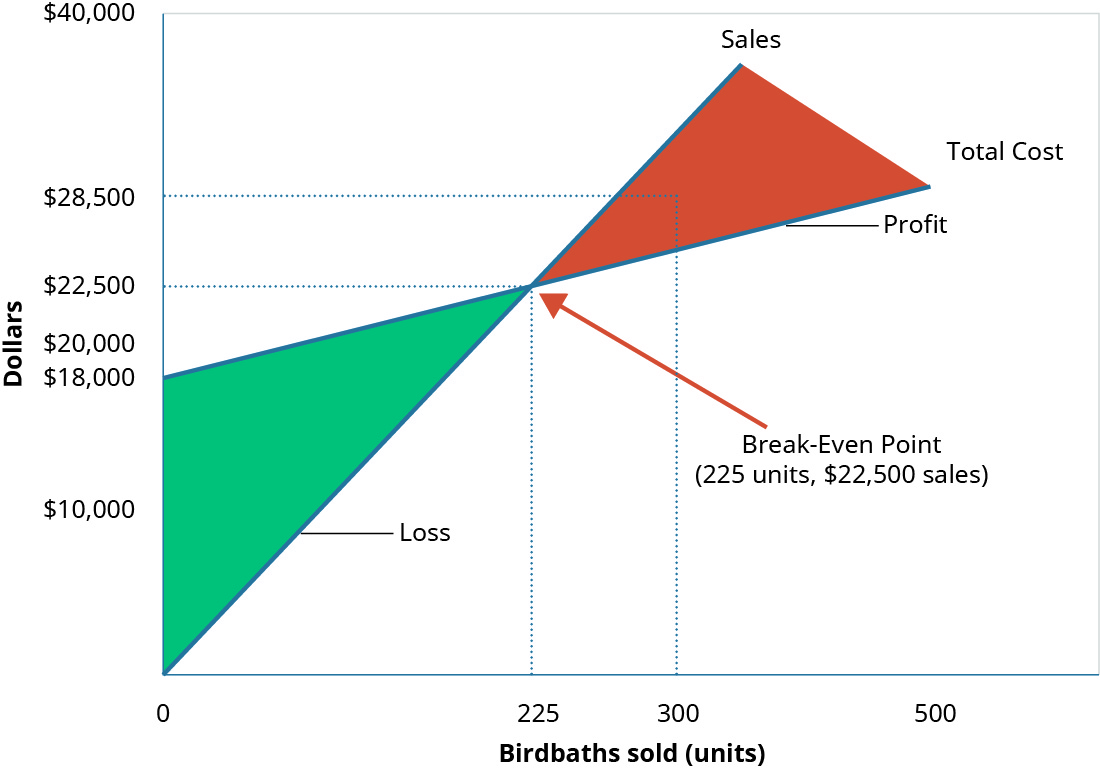

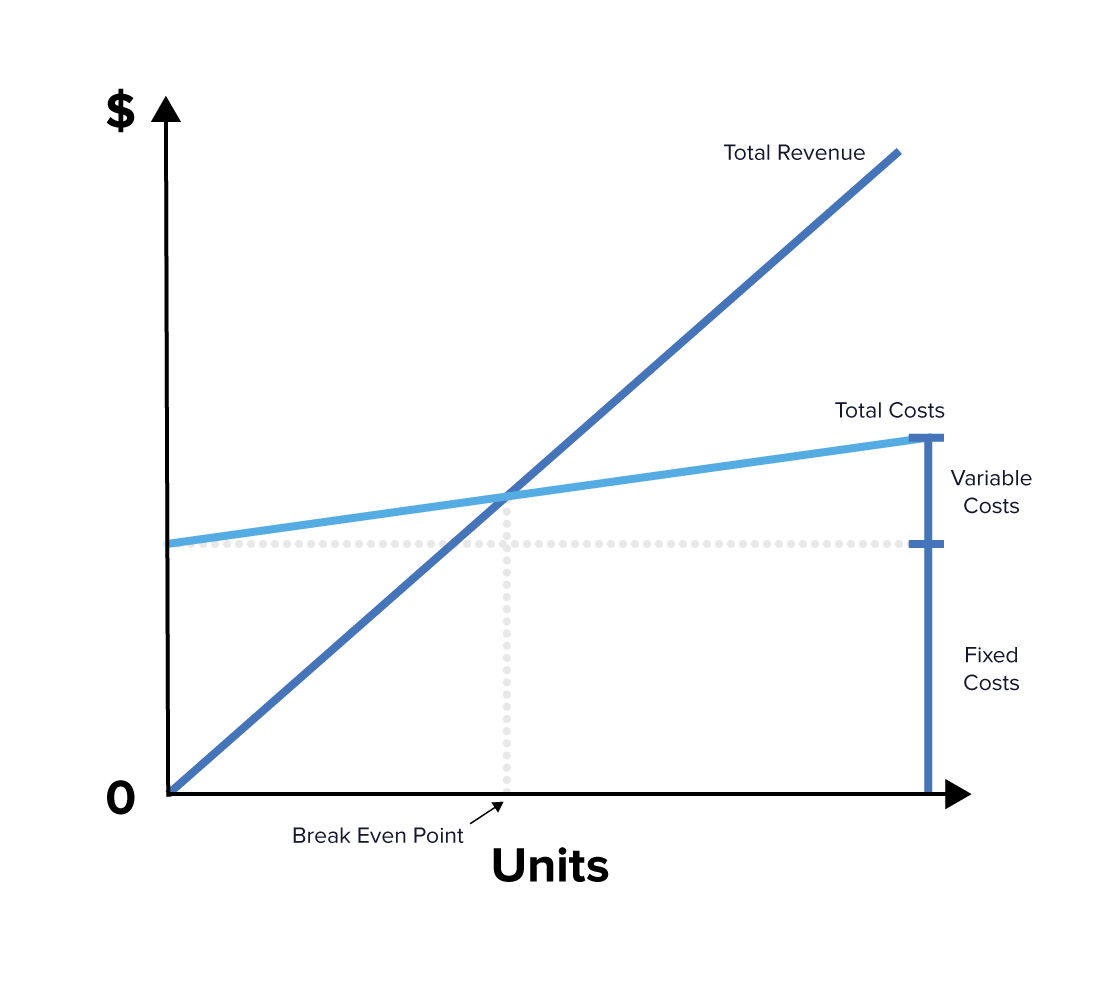

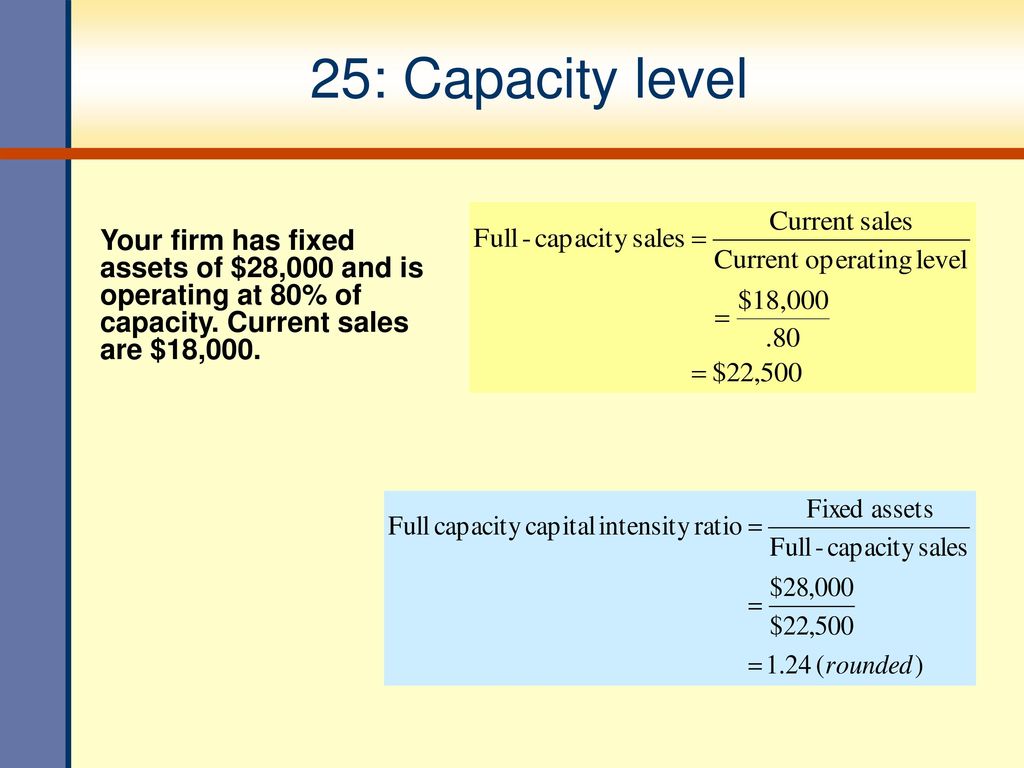

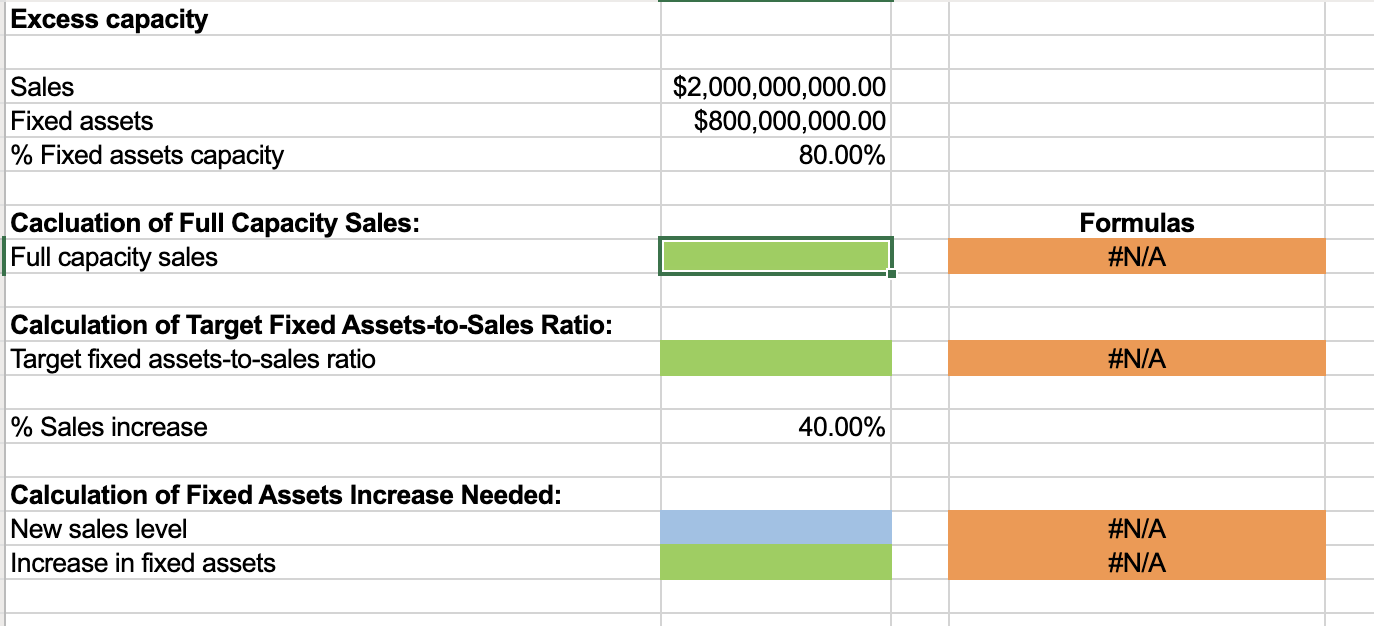

American depository receiptse ?investment bankers3) What is the formula for calculating the fullcapacity sales of a firm??a ?Fullcapacity sales = Existing sales level ÃPercent of capacity used to generate existing sales levelb ?Fullcapacity sales = Future sales level Ã(1 Percent of capacity used to generate future sales level)cIn calculating the breakeven point for KayaksForFun, we must assume the sales mix for the River and Sea models will remain at 60 percent and 40 percent, respectively, at all different sales levels The formula used to solve for the breakeven point in units for multipleproduct companies is similar to the one used for a singleproductTheir sales volume is 500 If the mascara was priced at $10 a unit, their total sales will be $5,000 for Q1 Businesses can vary on how they choose to measure their sales volume Some may use individual products as their basis of measurement, while others may

A Few Tips to Leverage Sales Capacity Planning A lot goes into sales capacity planning — for a little more depth, take a look at this blog post — but here are the 3 major points to help you leverage sales capacity planning for your company 1 Break down your goals — Before you start trying to increase your team's sales capacity, get1234 Available capacity per weekUsing the formula, Mr Weaver would expect to generate an additional $1,300 ($1,690 x 769%) in retained earnings if his sales increase by 30% next year Forecasted Financial Statements

Capacity Utilization Rate Formula Calculator Excel Template

/GrossProfitMargin-5c7cdf1546e0fb0001edc877.jpg)

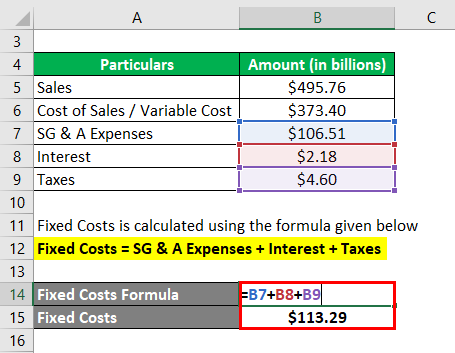

Profit Margin Formula Uses How To Calculate

1 Forecast Calculation Range of sales history to use in calculating growth factor (processing option 2a) = 3 in this example Sum the final three months of 05 114 119 137 = 370 Sum the same three months for the previous year 123 139The potential output is 60,000 stickers By using the formula of capacity utilization, we get – Capacity Utilization = Actual Output / Potential Output * 100 Or, Capacity Utilization = 40,000 / 60,000 * 100 = 6667% From the above, we can also find out the slack of Funny Stickers Co during the last month of 17Subjects Arts and Humanities Languages

Capacity Planning For Sales Blog Insight Partners

Break Even Point Definition Formula Example Uses Etc

Sales Revenue = 400 x $350 Sales Revenue = $140,000 By selling 100 units less in a year, your sales revenue drops by $35,000 this year However, if Projected sales are greater than full capacity sales, so there will be an increase in fixed assets The difference in projected sales and full capacity sales is $1,142,857, so you will use this number in the required level of fixed assets equation to⌧ Assembly 1000* 1500*22 600*25 = min = 1133,33 hr ⌧ Inspection 1000*2 1500*2 600*2,4 = 6440 min = 107,33 hr etc ⌧ available capacity per week is 10 hr for the assembly work center and 110 hours for the inspection station;

Calculating Breakeven Output Formulae Tutor2u

11 Sales Metrics That Highly Productive Teams Track

The percent of sales method is a financial forecasting model in which all of a business's accounts — financial line items like costs of goods sold, inventory, and cash — are calculated as a percentage of sales Those percentages are then applied to future sales estimates to project each line item's future value A resource planning formula will use several important variables First, you need to understand the FullTime Equivalent or FTE of employees FTE is a unit of measure that indicates the amount of capacity or availability of an individual to work during a specified time period You're probably already familiar with FTE, but if you are experiencing a lot of resource conflicts, the Q7 In the formula Production capacity (in pieces) = (Capacity in hours*60/product SAM)* line efficiency What is (60) in this formula I cannot figure it out Please help Answer In the formula, 60 is used to convert hours into minutes Garment SAM is in minute, but we the calculated factory capacity is in hours (see step#1)

2

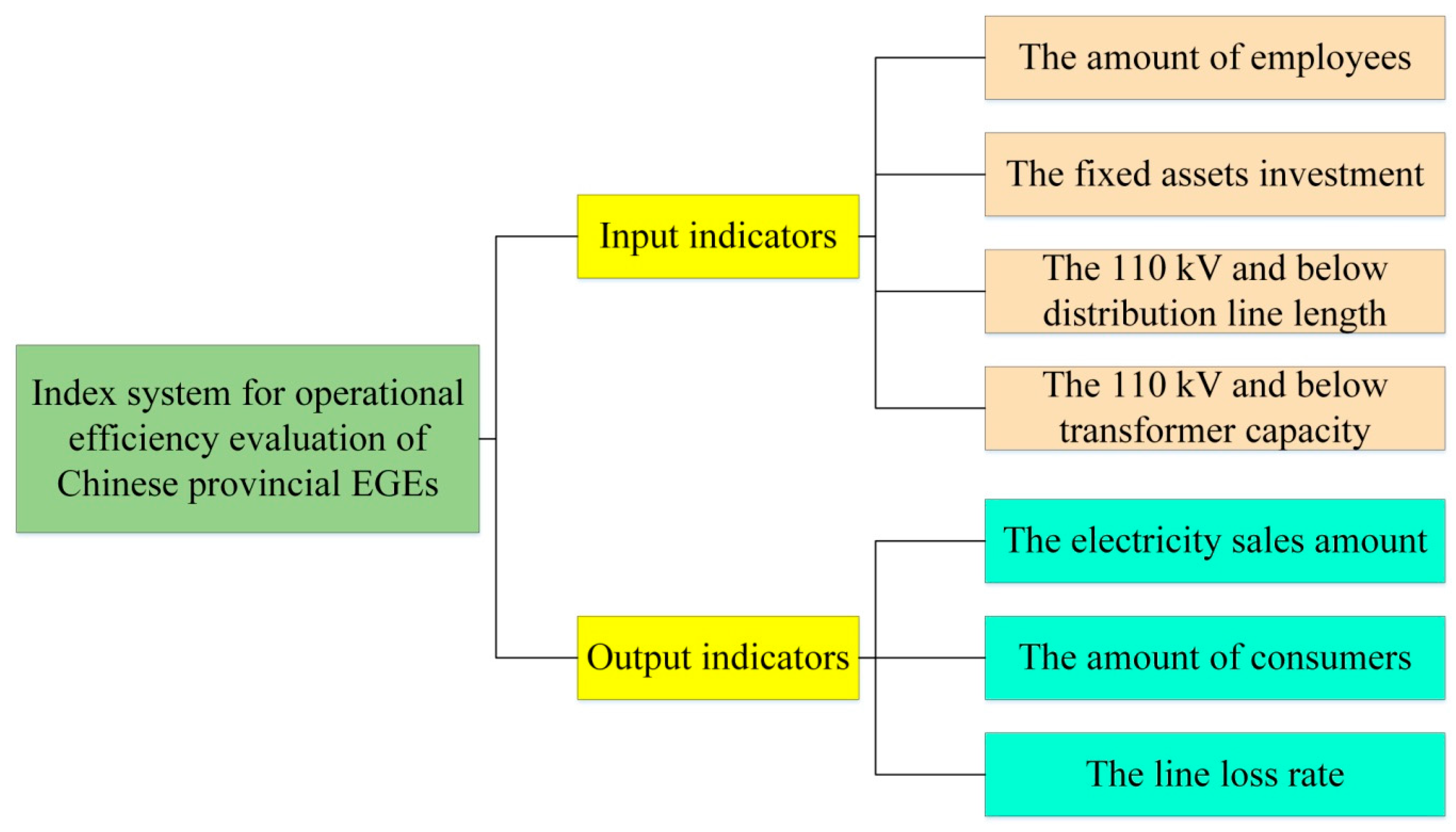

Sustainability Free Full Text Operational Efficiency Of Chinese Provincial Electricity Grid Enterprises An Evaluation Employing A Three Stage Data Envelopment Analysis Dea Model Html

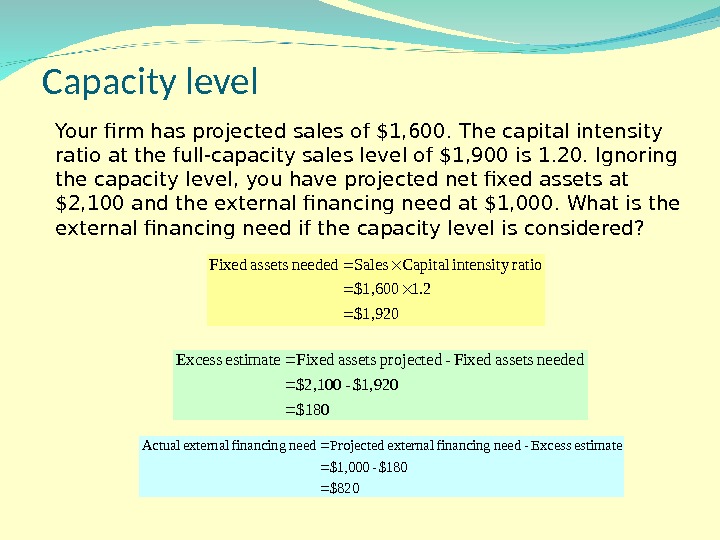

Since the company is at full capacity, its assets must increase in proportion to sales The company also estimates that if sales increase percent, spontaneous liabilities will increase by $2 million If the company's sales increase, its profit margin will remain at its current level The company's dividend payout ratio is 40 percentThe Profit Formulas are given as Formula for Profit Profit = SP – CP Formula for Profit Percentage Profit Percent Formula = P rofit×100 CP P r o f i t × 100 C P Gross Profit Formula Gross Profit = Revenue – Cost of Goods Sold Profit Margin Formula Profit Margin = T otal Income N et Sales ×100 T o t a l I n c o m e N e t S aCapital Intensity Ratio Formula You can calculate the capital intensity ratio by dividing a company's total assets by its sales or taking its reciprocal of total assets turnover ratio, as you can see in the formulas below For this type of ratio, smaller figures are better The lower the ratio, the less capital you need to operate your business

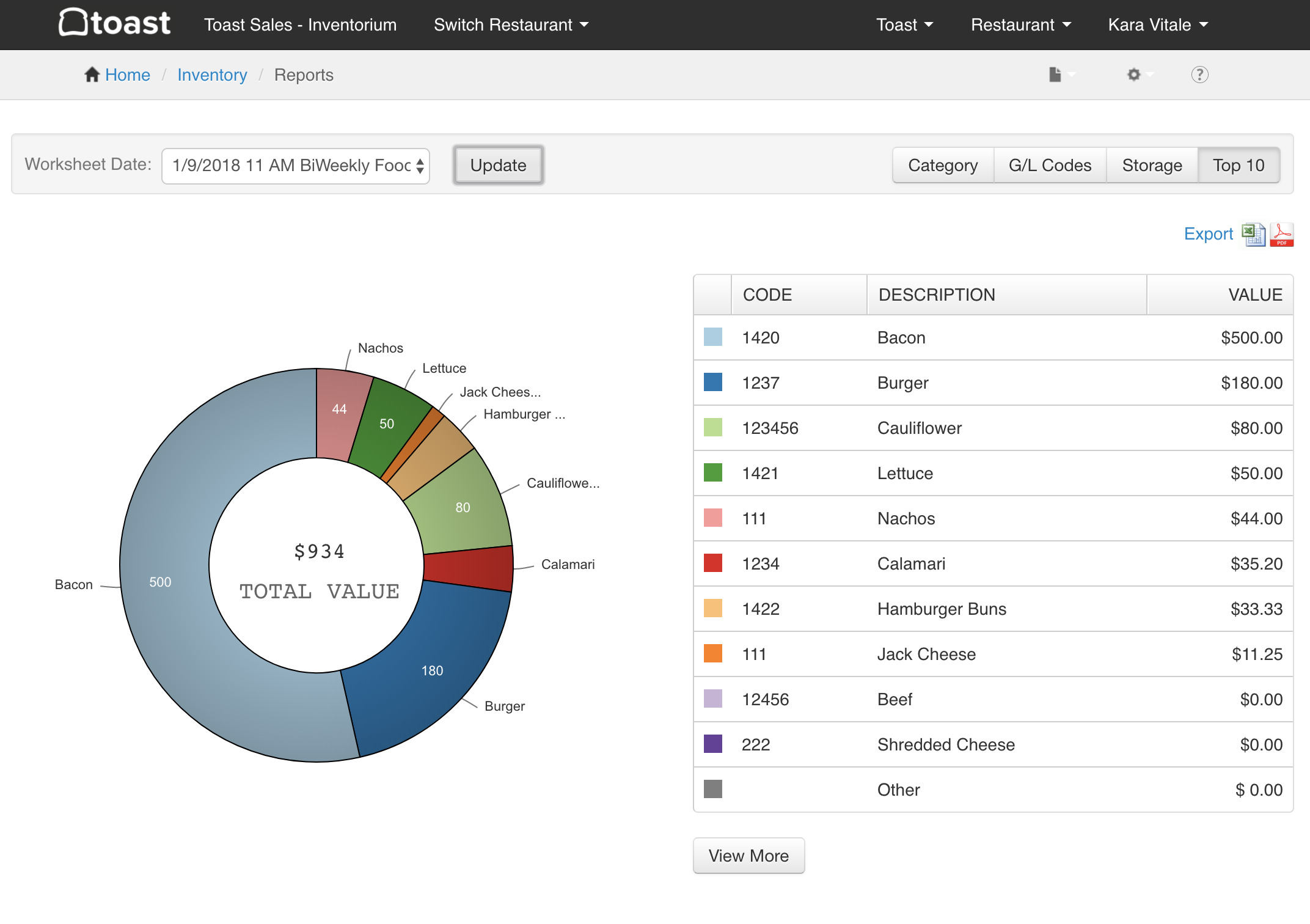

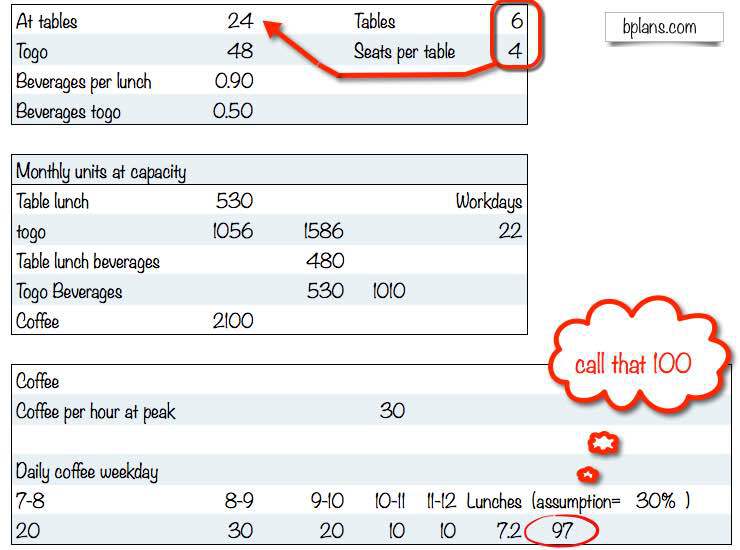

How To Conduct An Accurate Restaurant Sales Forecast Toast Pos

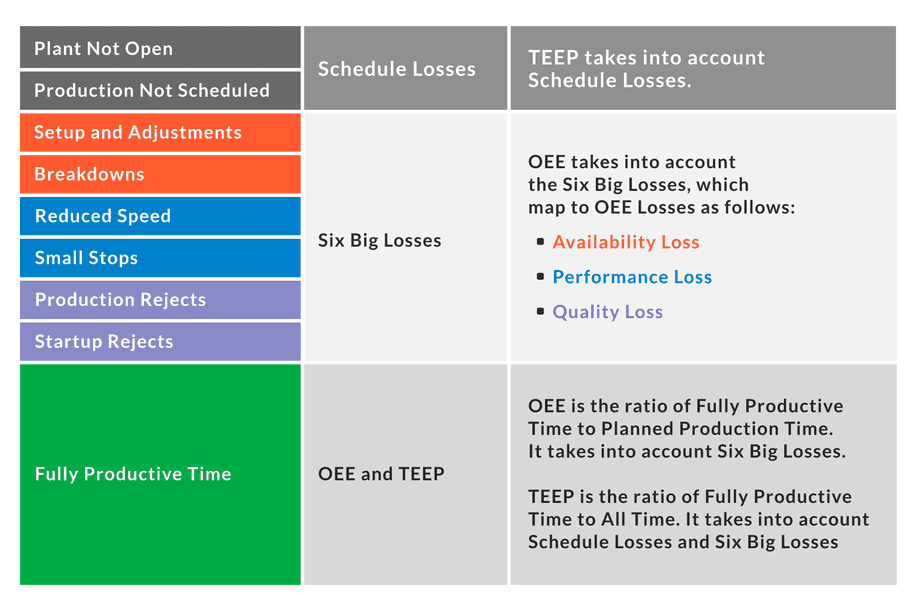

Calculate Teep Increase Equipment Utilization Oee Oee

Bill of capacity (min) ⌧ weekly capacity requirements?Inventory Levels Production per month Sales and Operations Planning Iterative Nature of S&OP 1 Develop production plan 2 –Produces at or close to full capacity for all of the cycle –Subcontracts for demand above the minimum –Makes full use of available capacity, andQuestion 11 1 pts Based on its existing sales, what is the formula for calculating the fullcapacity sales of a firm?

Sales Commission Structures Everything You Need To Know Xactly

1

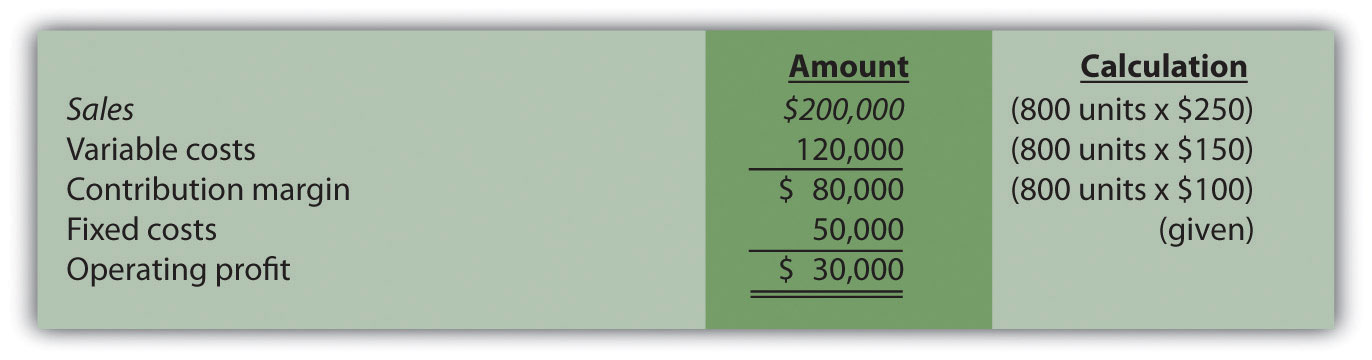

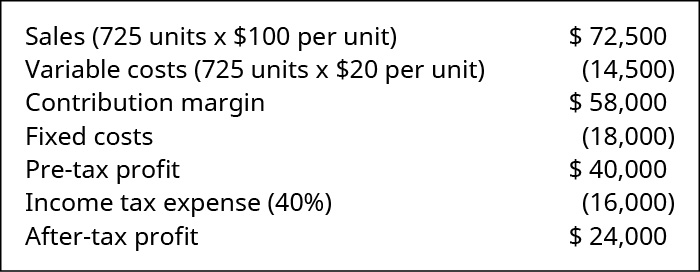

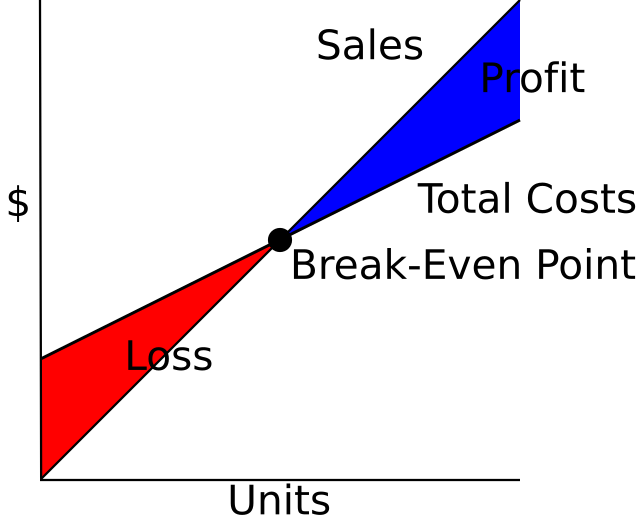

Contribution Margin Formula Components There are two main components in the contribution margin equation net sales and variable costs Let's take a look at each What are net sales? Capacity is the maximum level of output that a company can sustain to make a product or provide a service Planning for capacity requires management to accept limitations on the production processEg if you find that your sales in a recent month, when your profit was a breakeven, were $1,000,000, you should also look at the change in your inventory level in that month If your inventory increased by $100,000 then your breakeven production level is actually (assuming a 30% gross margin = 70% variable expenses) $1,000,000 (100,000

First We Need To Calculate Full Capacity Sales Which Is Full Capacity Sales Course Hero

Sales Revenue Formula Calculate Grow Total Revenue

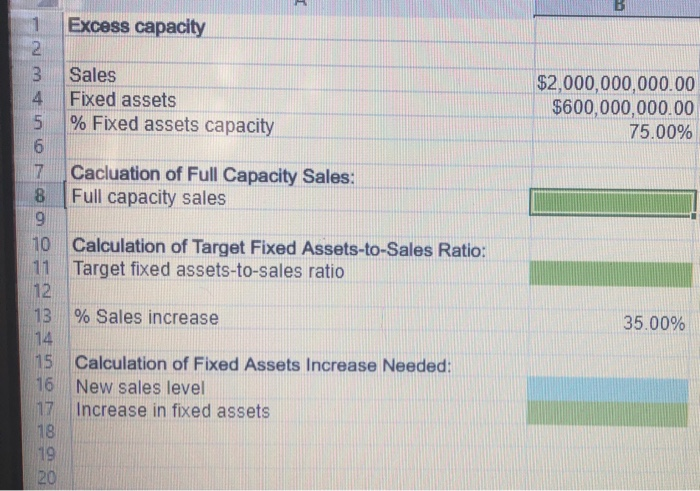

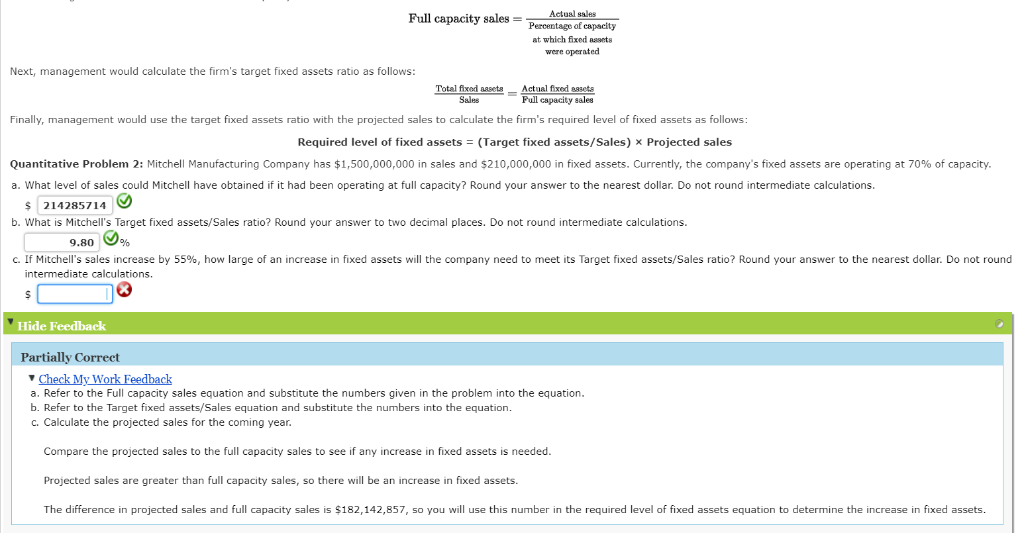

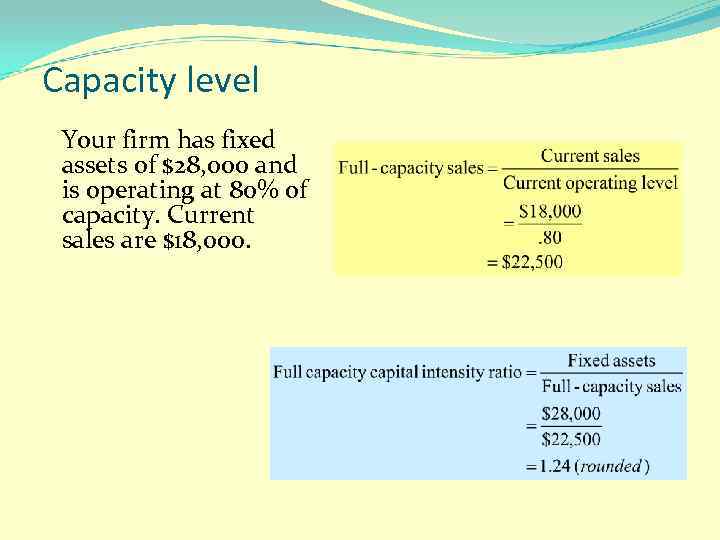

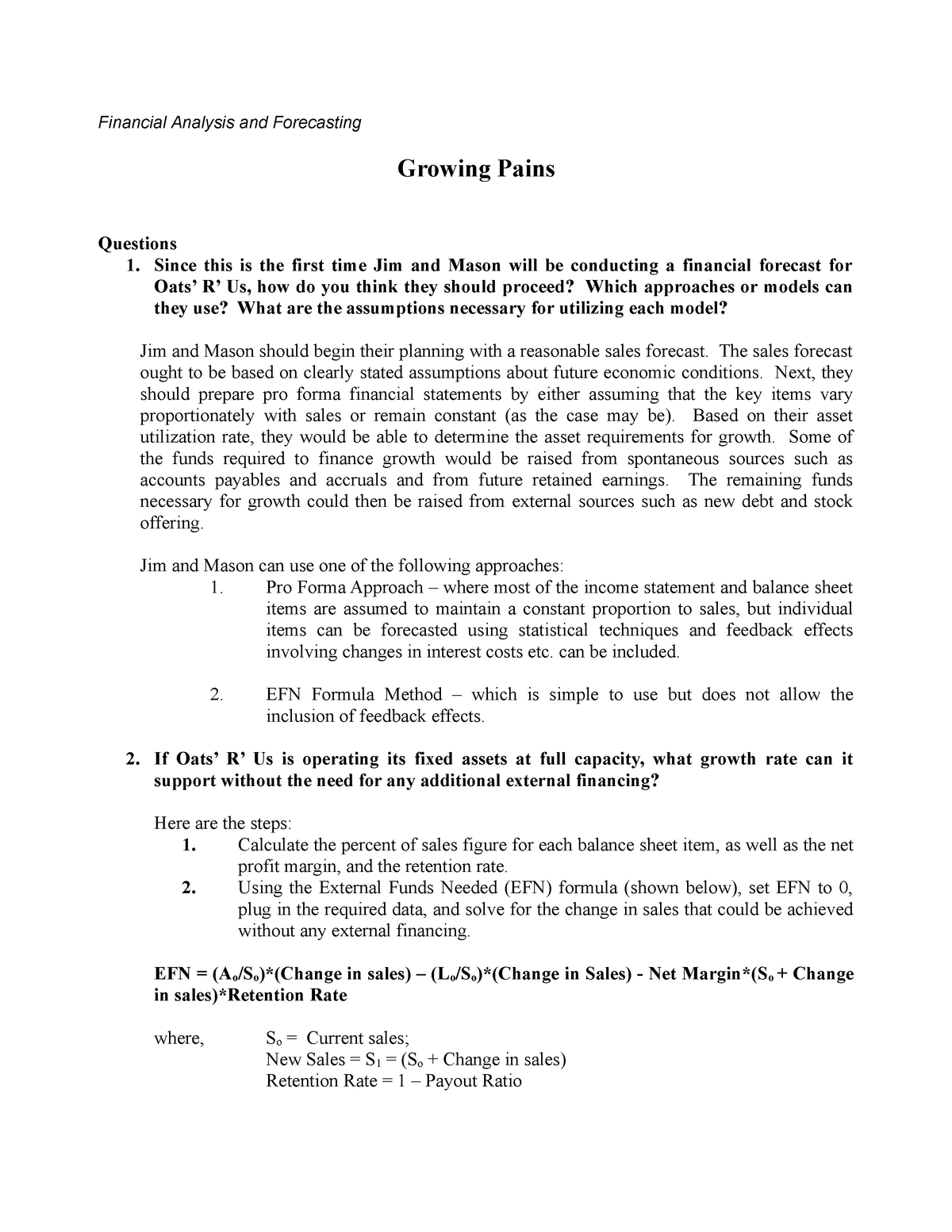

The margin of safety is a ratio measuring the gap between sales and breakeven point or the difference between market value and intrinsic value The formula for margin of safety requires two variables current/estimated sales and breakeven point The term margin of safety is used in different contexts but most of them have a similar meaning in 28 First, we need to calculate full capacity sales, which is Full capacity sales = $905,000 / 80 Full capacity sales = $1,131,250 The capital intensity ratio at full capacity sales is Capital intensity ratio = Fixed assets / Full capacity sales Capital intensity ratio = $364,000 / $1,131,250 Capital intensity ratio = The fixed assetsAnd (5) all assets as well as spontaneous liabilities as shown on the balance sheet are expected to grow proportionally with sales Further, your boss estimates she will need to raise $2 million externally

Understanding Capacity Utilization Rates Wrike

What Makes Good Sales Data Zendesk

Plant Capacity Level Type # 3 Capacity to Make and Sell If the concern is not able to sell the entire quantity produced due to lack of demand, it will not work at full capacity The capacity based on expected sales is, therefore, the capacity required toThe ROI formula typically uses _____ a end of year operating and nonoperating assets When a department has no idle capacity and will interrupt their current level of sales to regular customers, the lowest acceptable transfer price to supply product to another division is _____ d the selling division is operating at full capacity dThe company has $70 million in total assets Over the next year, the company is forecasting a percent increase in sales Since the company is at full capacity, its assets must increase in proportion to sales The company also estimates that if sales increase percent, spontaneous liabilities will increase by $2 million

5 Steps To Build An Accurate Restaurant Sales Forecast In 21

8 Of 9 Question 4 Total Marks 25 Marks A Basic Lad Sells Product X For Homeworklib

Full Capacity BIBLIOGRAPHY Full capacity refers to the potential output that could be produced with installed equipment within a specified period of time Actual capacity output can vary within two limits (1) an upper limit that refers to the engineering capacity — that is, the level of output that could be produced when the installed equipment is used to its maximum time of operation The capacity utilization rate is Capacity Utilization = (Actual level of output / maximum level of output) * 100 Capacity Utilization = (/000) * 100 Capacity Utilization = 50% If all the resources are utilized, then the capacity rate is 100%, and this indicates full capacity It is unlikely that a company achieves 100% rate everyFull Capacity Sales Definition The amount of sales when machines are 100% utilized If S1>Full Capacity Sales Full Capacity Sales Formula FCS = actual sales (S0) / % at which machines operate;

2

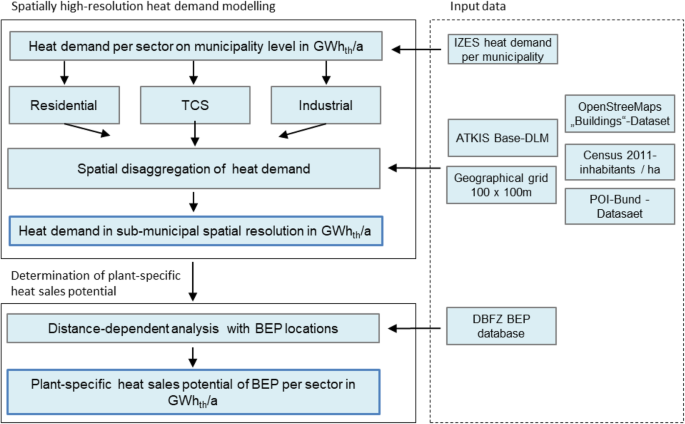

Bioenergy Plants Potential For Contributing To Heat Generation In Germany Energy Sustainability And Society Full Text

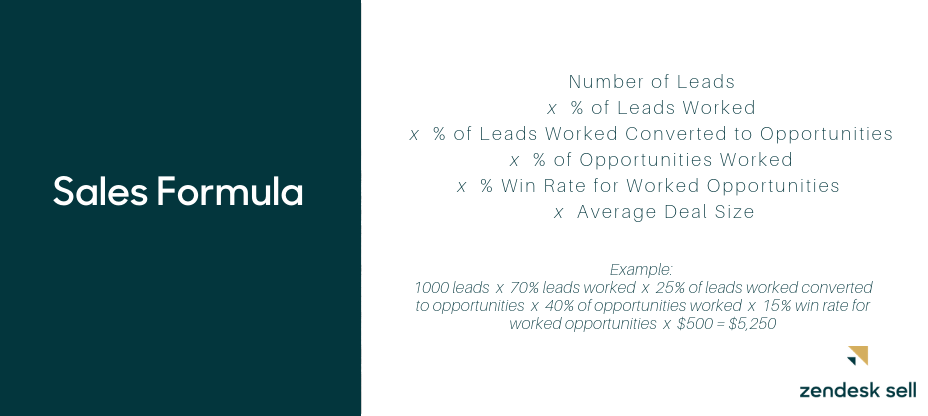

The required sales level is $900,000 and the required number of units is 300,000 Why is the answer $900,000 instead of $810,000 ($750,000 break‐even sales plus $60,000)?Calculated as the last term of equation (1) by multiplying forecasted sales by the net profit margin and the retention rate Thus, when financing costs change substantially, the AFN formula can substantially under or overstate state funds requirements, because the net profit margin and retention ratio are assumed constant from the base period For sales management, a key element that gets measured is sales capacity Your sales capacity is the answer you obtain from the following equation the number of sales reps you have on the team, multiplied by the number of weekly hours that your team works per year, multiplied by the percentage of time spent selling and finally multiplied by

How Many Leads Do I Need To Make A Sale Belkins B2b Lead Generation Blog

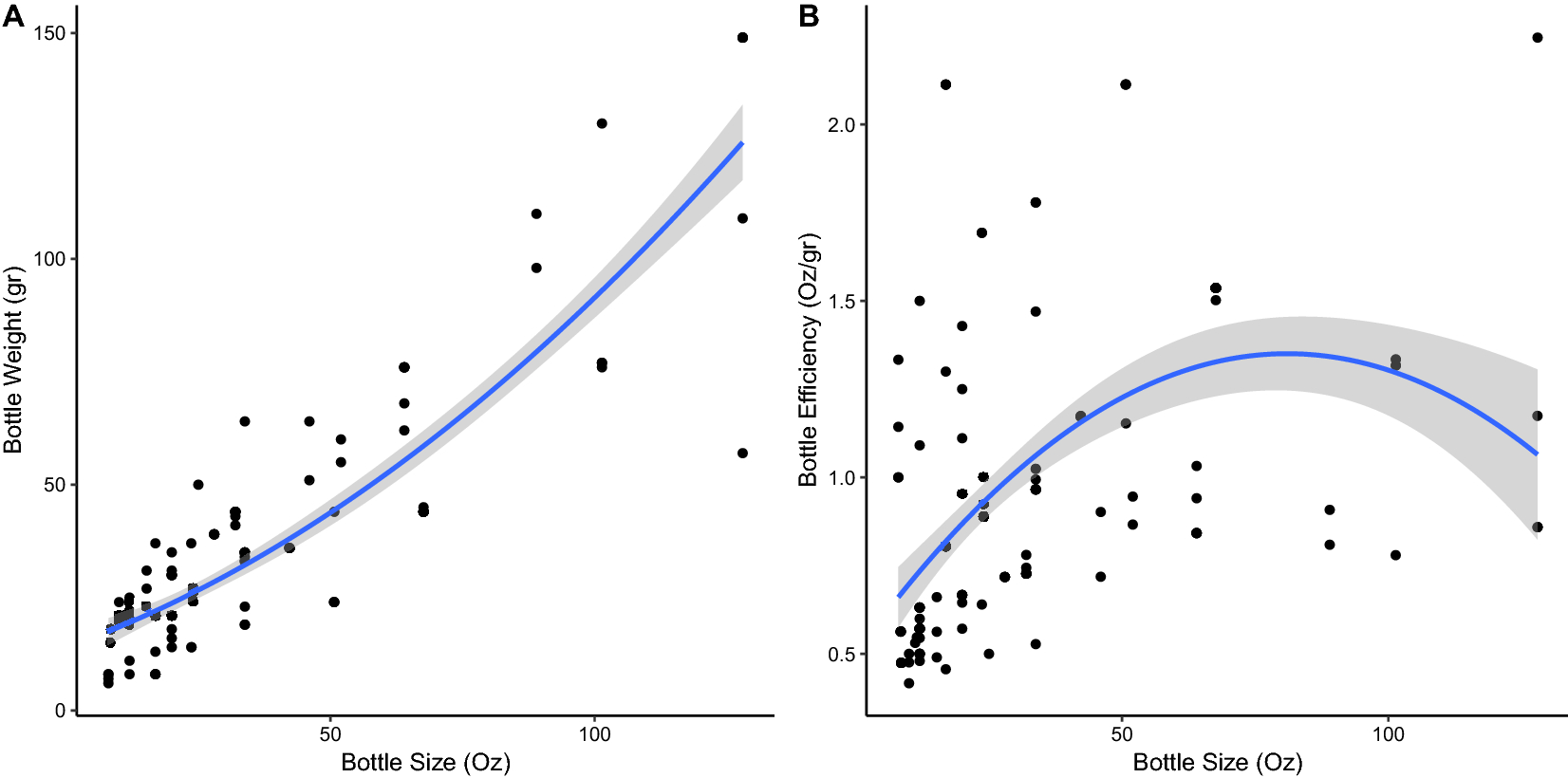

Beverage Bottle Capacity Packaging Efficiency And The Potential For Plastic Waste Reduction Scientific Reports

Remember that there are additional variable costs incurred every time an additional unit is sold, and these costs reduce the extra revenues when calculating incomeFullcapacity sales = Future sales level Percent of capacity used to generate existing sales level Fullcapacity sales = Existing sales level Percent of capacity used to generate existing sales level Fullcapacity sales Where, A o = current level of assets L o = current level of liabilities ΔS/S o = percentage increase in sales ie change in sales divided by current sales S 1 = new level of sales PM = profit margin b = retention rate = 1 – payout rate A negative figure for additional funds needed means that there is a surplus of capital

Capacity Vs Energy A Primer

Machine Capacity Calculation Smart And Lean

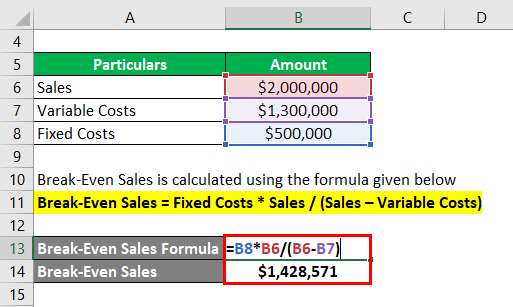

Break Even Sales Formula Calculator Examples With Excel Template

Cost Volume Profit Analysis F5 Performance Management Acca Qualification Students Acca Acca Global

Breakeven Sales Volume Ag Decision Maker

Solved B How Would Your Answer In Part A Change It The E Courses Archive

How To Build A Sales Process A Complete Guide Salesforce Com

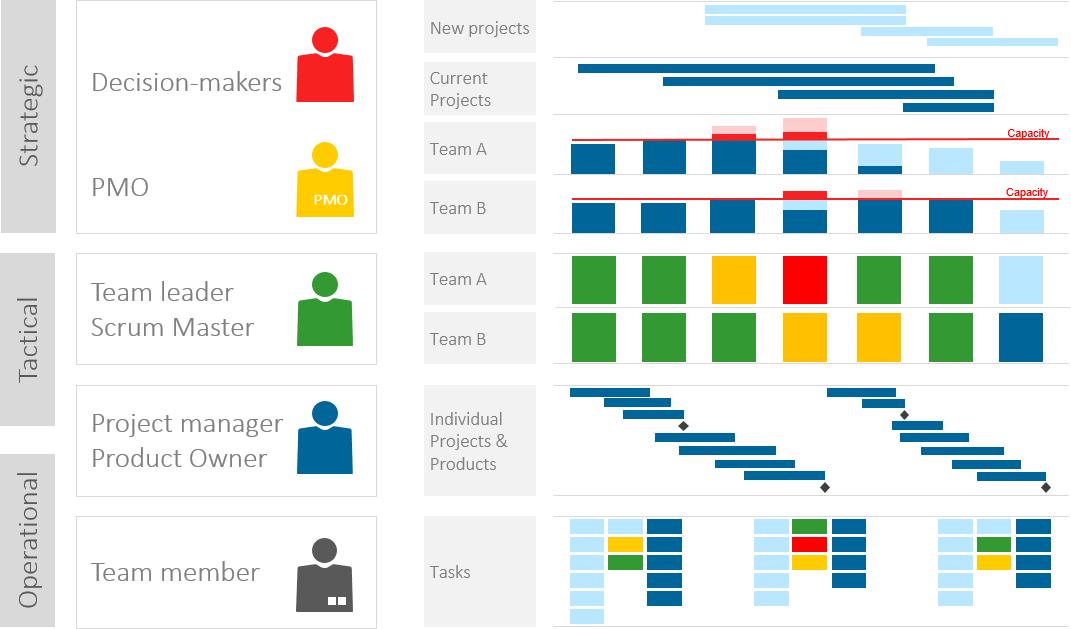

Capacity Planning 101 Building A Sales Plan

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

Gartner Blog Network

Capacity Planning In Project Management 4 Vital Success Factors Update 21

Cost Volume Profit Analysis For Single Product Companies

Sales Objectives Examples Pipedrive

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

Break Even Economics Wikipedia

Zimn878urfutkm

Solved 1 2 000 000 000 00 600 000 000 00 75 00 1 Excess Chegg Com

The Percentage Of Sales Method Formula Example Video Lesson Transcript Study Com

First We Need To Calculate Full Capacity Sales Which Is Full Capacity Sales Course Hero

Capacity Formula

Developing And Validating A National Logistics Cost In Thailand Sciencedirect

Sales Capacity Planning Are You Getting The Most Out Of Your Sales Team Espatial

:max_bytes(150000):strip_icc()/how-to-calculate-breakeven-point-393469_FINAL-5b73401446e0fb00501b47d1.png)

Use This Formula To Calculate A Breakeven Point

Break Even Sales Formula Calculator Examples With Excel Template

2

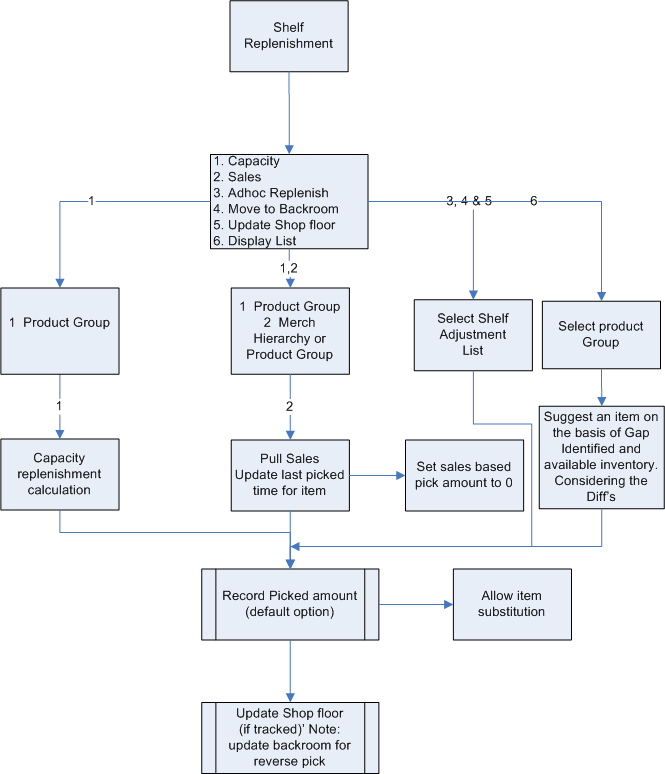

Shelf Replenishment

Inventory As A Percent Of Sales Plex Demandcaster

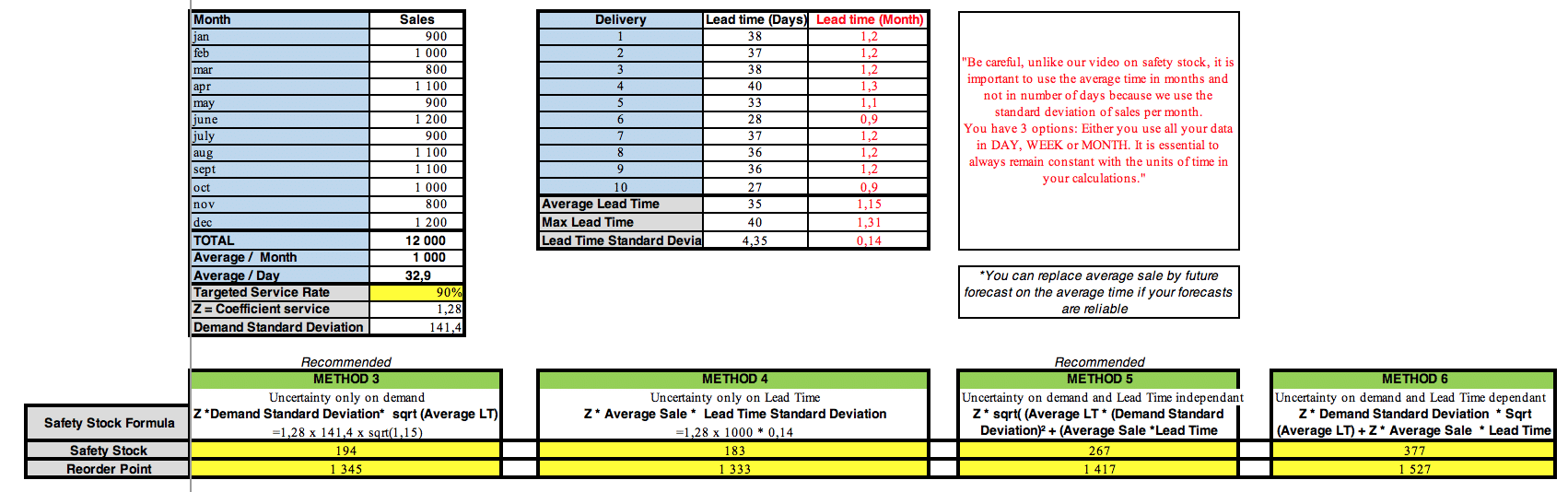

6 Best Safety Stock Formulas On Excel Abcsupplychain

Sales Ramp Up Time Everything You Need To Know Xactly

How To Calculate Workplace Productivity Smartsheet

13 Important Sales Metrics And When To Use Them

What Is Sales Volume Definition And Calculation

Sales Capacity Planning Are You Getting The Most Out Of Your Sales Team Espatial

Financial Planning And Forecasting Financial Statements Ppt Video Online Download

Break Even Analysis Decision Making Skills Training From Mindtools Com

Plowback And Dividend Payout Ratios Your Company Has

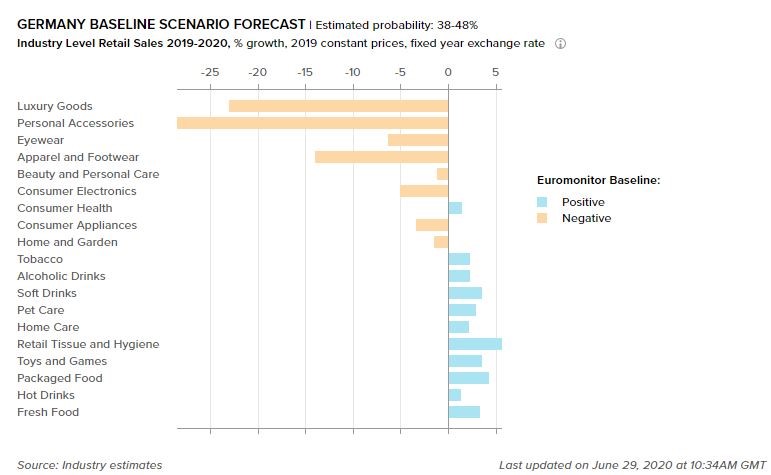

Impact Of Coronavirus In Germany Food Drinks Tobacco And Out Of Home Experiences Euromonitor Com

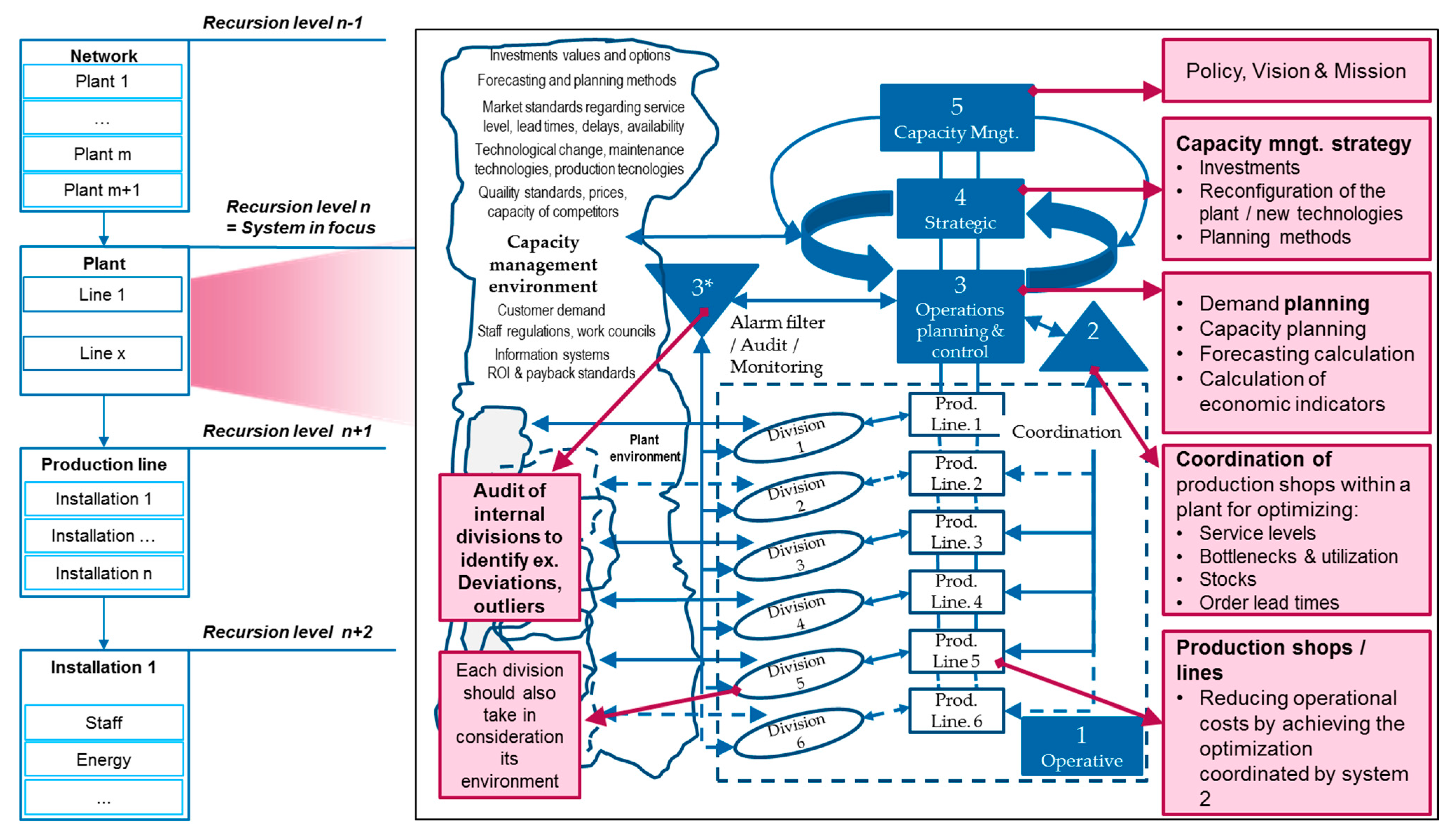

Applied Sciences Free Full Text Design And Simulation Of A Capacity Management Model Using A Digital Twin Approach Based On The Viable System Model Case Study Of An Automotive Plant Html

2

Naahq Org

Capacity Utilization Definition Example And Economic Significance

What Is Break Even Point Analysis Formula And Template 21

Real Options Models Of The Firm Capacity Overhang And The Cross Section Of Stock Returns Aretz 18 The Journal Of Finance Wiley Online Library

Can Capacity Planning Technology Help Plan Labor Budget

Determination Of Sales Volume In Rupees At Desired Level Of Profit In Accounts And Finance For Managers Tutorial 17 November 21 Learn Determination Of Sales Volume In Rupees At Desired Level

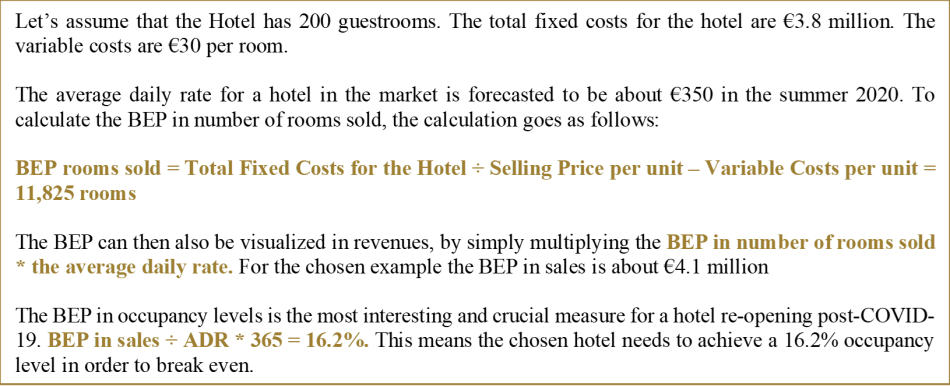

How To Calculate And Monitor Your Hotel Break Even Point

Incremental Sales A Crucial Kpi To Guide Your Marketing Efforts

Working Capital Management Estimation And Calculation Taxmann Blog

Solved Full Capacity Sales Actual Sales Percentage Of Chegg Com

Long Term Financial Planning And Growth Ch 4

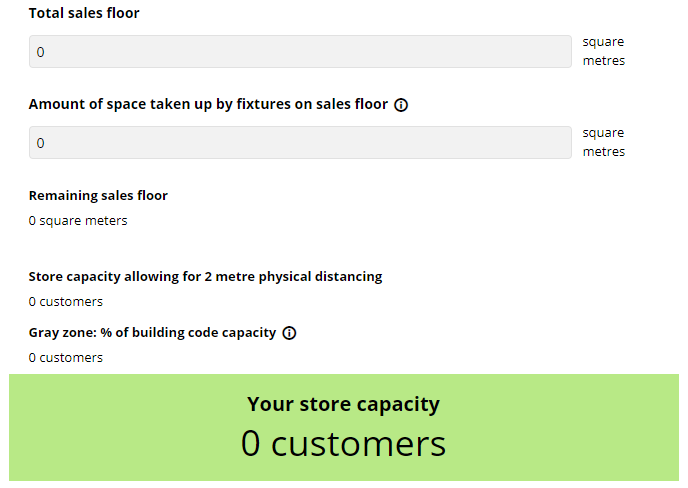

Store Capacity Calculator Retail Council Of Canada

Break Even Analysis Definition Formula Examples

What Is Utilization How Do You Calculate Utilization Rate

Cost Volume Profit Analysis

Long Term Financial Planning And Growth Ppt Download

Are You Calculating Your Sales Capacity Correctly Pivotal Advisors

Fin 300 Full Capacity Sales Of Fixed Assets Example 1 Ryerson University Youtube

Capacity Utilization Rate Definition Formula How To Calculate

Break Even Sales Formula Calculator Examples With Excel Template

Chapter 17 Mc Grawhillirwin Projecting Cash Flow And

How To Make And Use A Proper Sales Bookings Productivity And Quota Capacity Model Kellblog

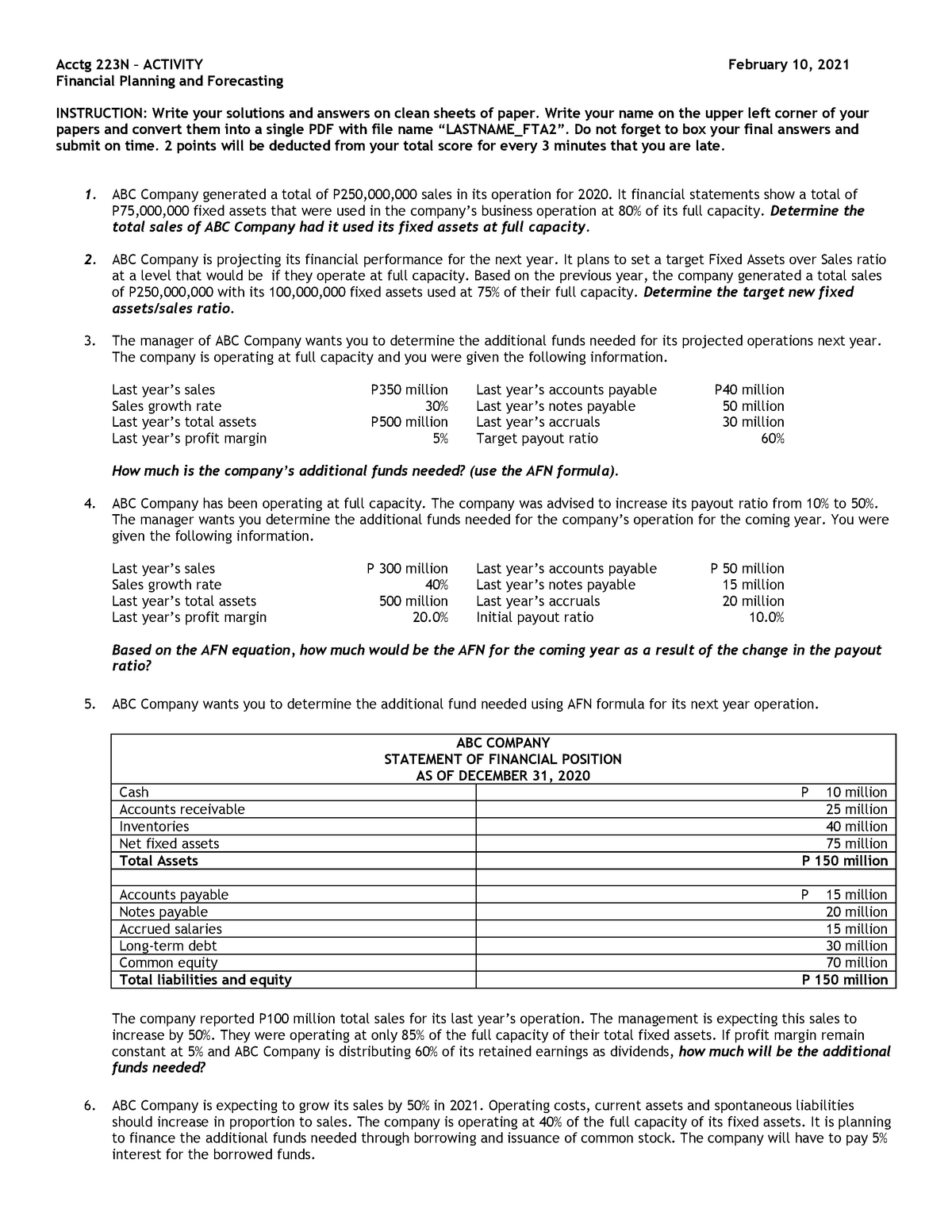

Activity On Forecasting Basic Accounting Ba101 Studocu

Edexcel A Level Business Calculation Practice Business Tutor2u

Growing Pains Case Problem Solutions Management Accounting Chmsc Studocu

How Can I Calculate Break Even Analysis In Excel

Solved Excel Online Structured Activity Excess Capacity Chegg Com

Sales Revenue Formula Calculate Grow Total Revenue

Break Even Sales Formula Calculator Examples With Excel Template

Transfer Pricing F5 Performance Management Acca Qualification Students Acca Global Acca Global

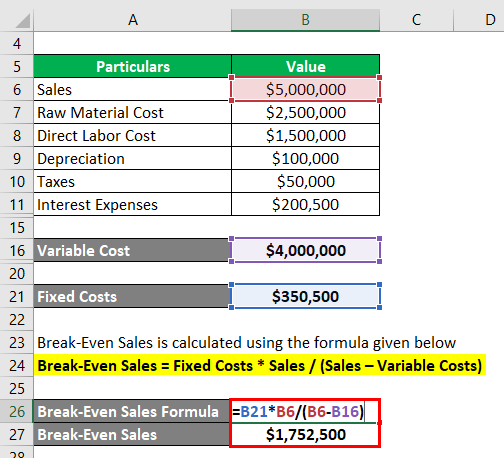

Ontario Rcc S Store Capacity Limit Calculation Tool Updated Retail Council Of Canada

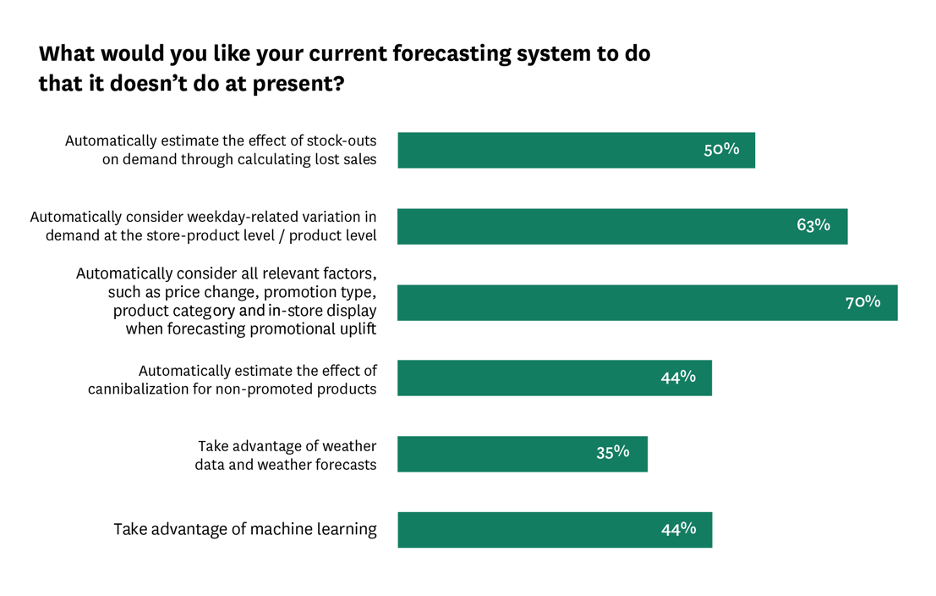

4 Keys To Better Retail Promotion Forecasting And Replenishment Relex Solutions

Capacity Planning 101 Building A Sales Plan

Presentation On Project Finance Organised By Institute Of

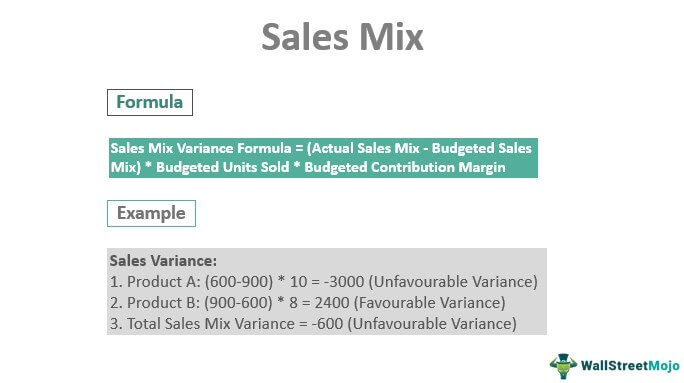

Sales Mix Definition Formula Calculate Sales Mix Variance

Pdf Direct Salesforce Versus Independent Reps A Strategic Choice Across A Business Life Cycle

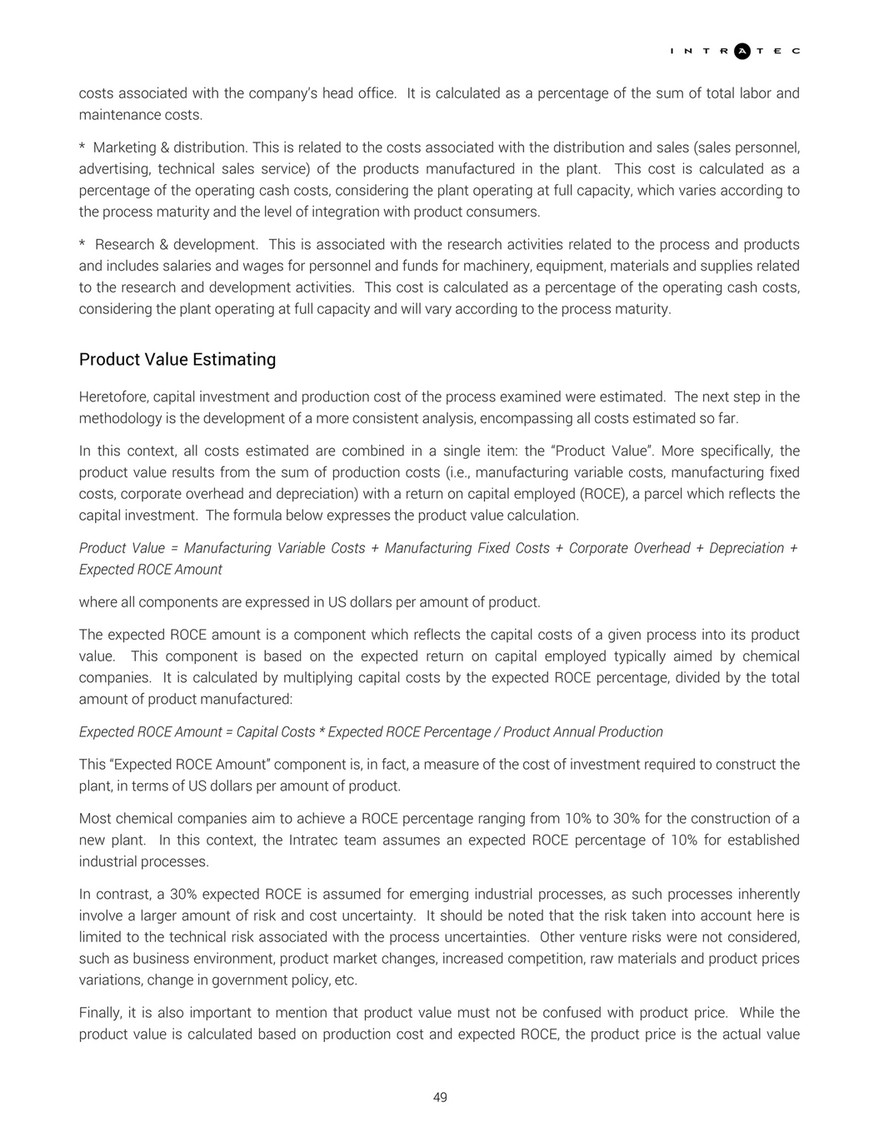

Intratec Solutions Economics Of Methanol Production From Natural Gas Page 50 51 Created With Publitas Com

How To Calculate Market Share And Find New Growth Avenues

6 Best Safety Stock Formulas On Excel Abcsupplychain

Top 13 Sales Pipeline Metrics To Track In 21 According To The Experts

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition Formula Examples

0 件のコメント:

コメントを投稿